Anna Kowalska

właścicielka sklepu, Białystok

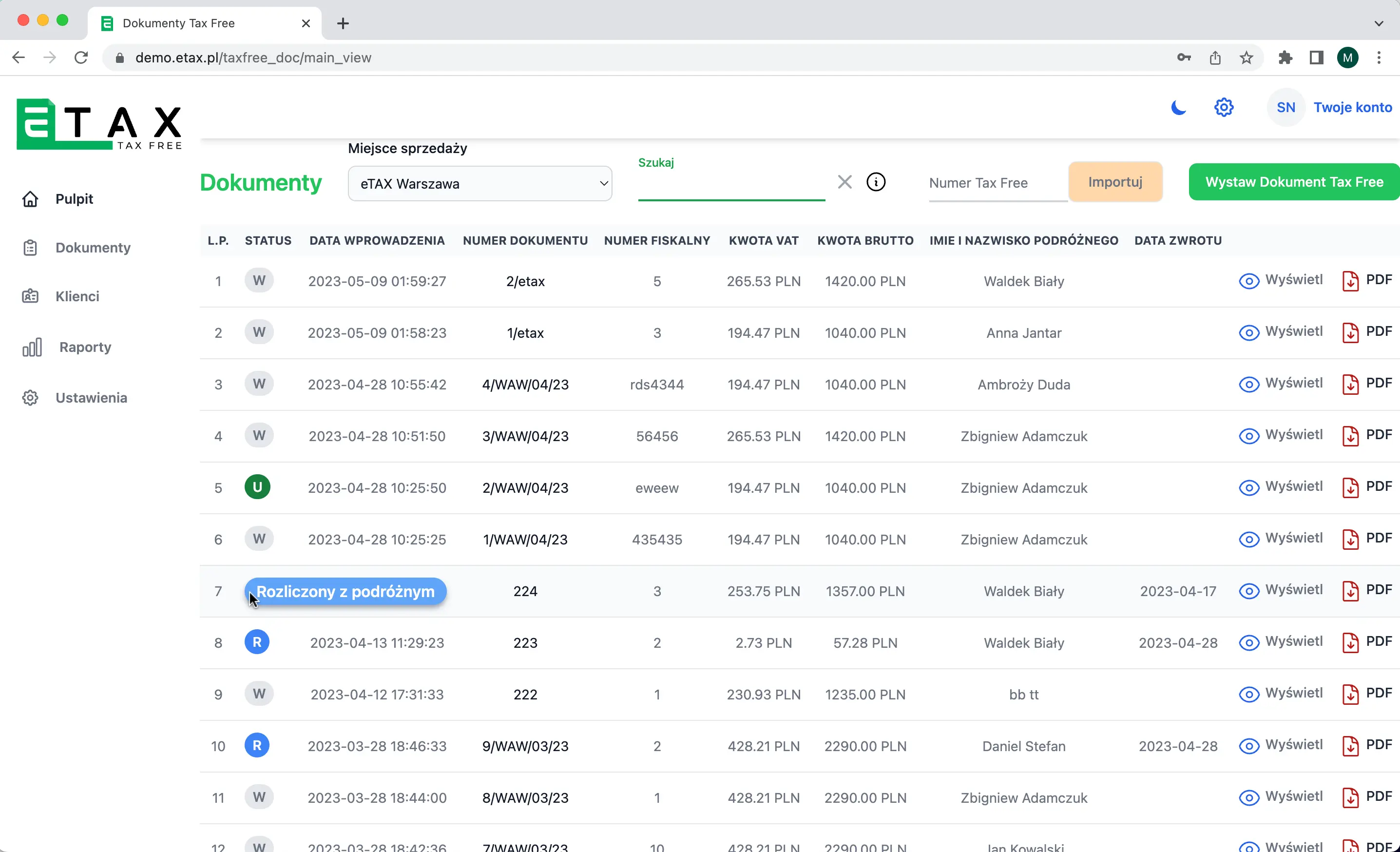

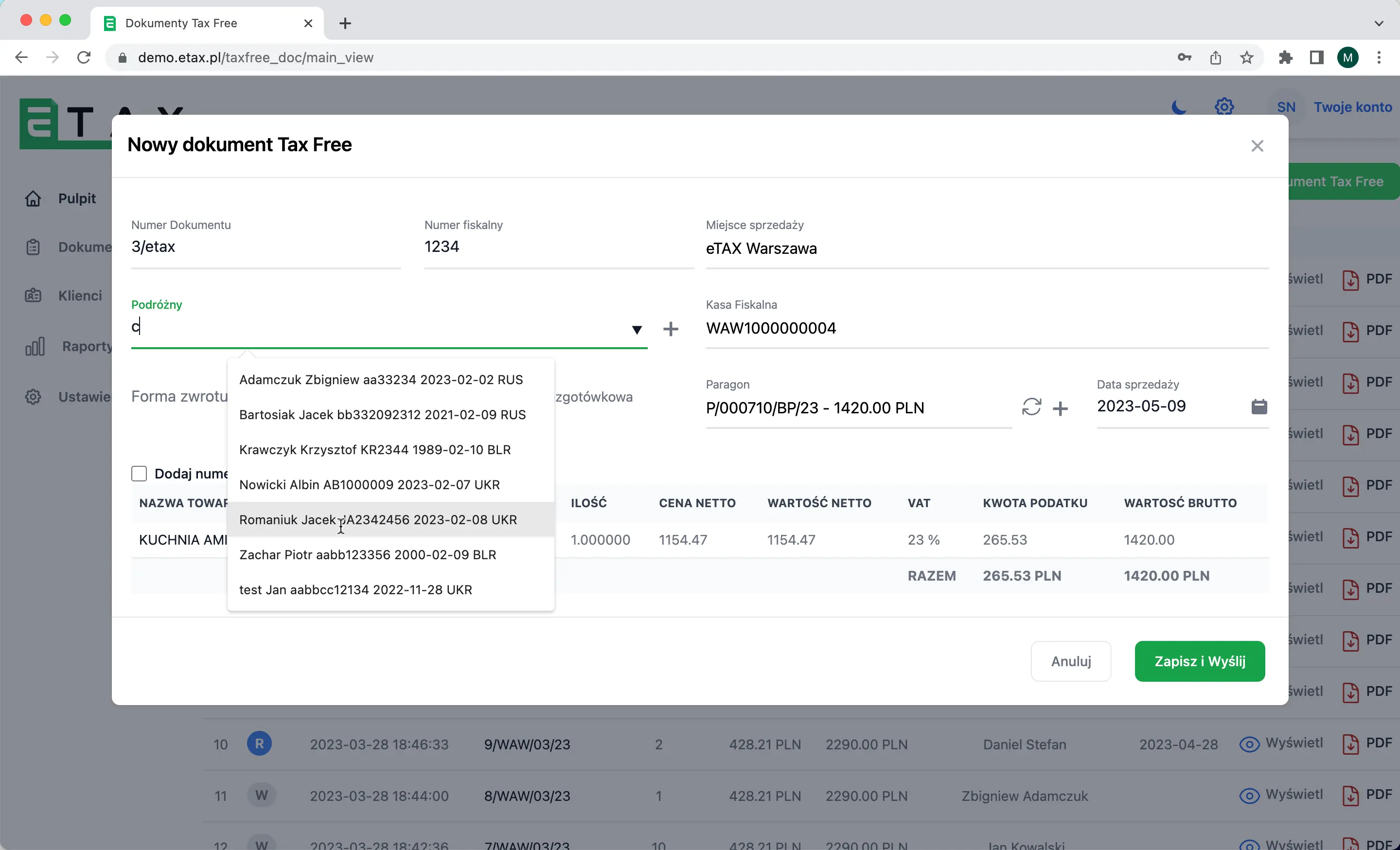

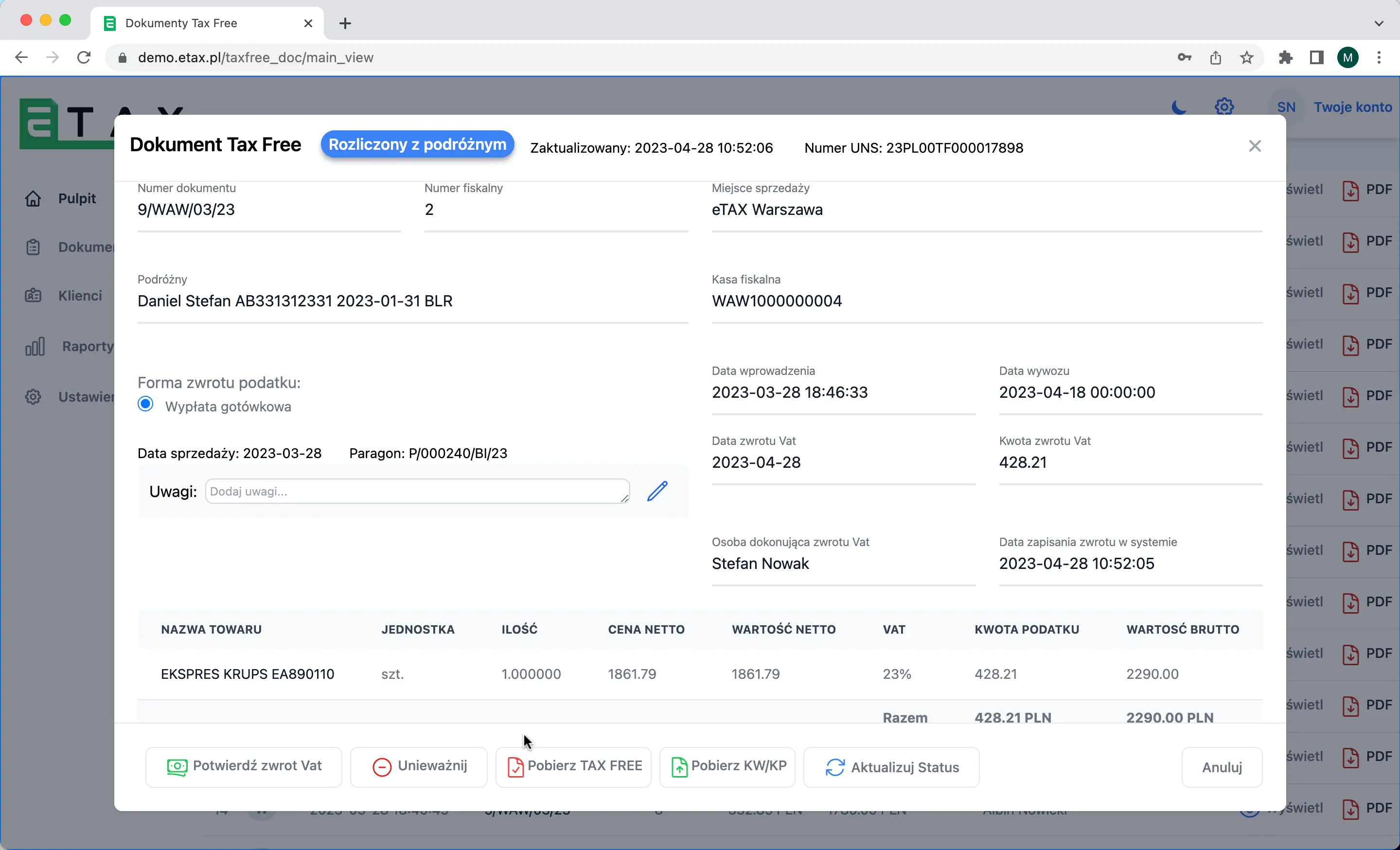

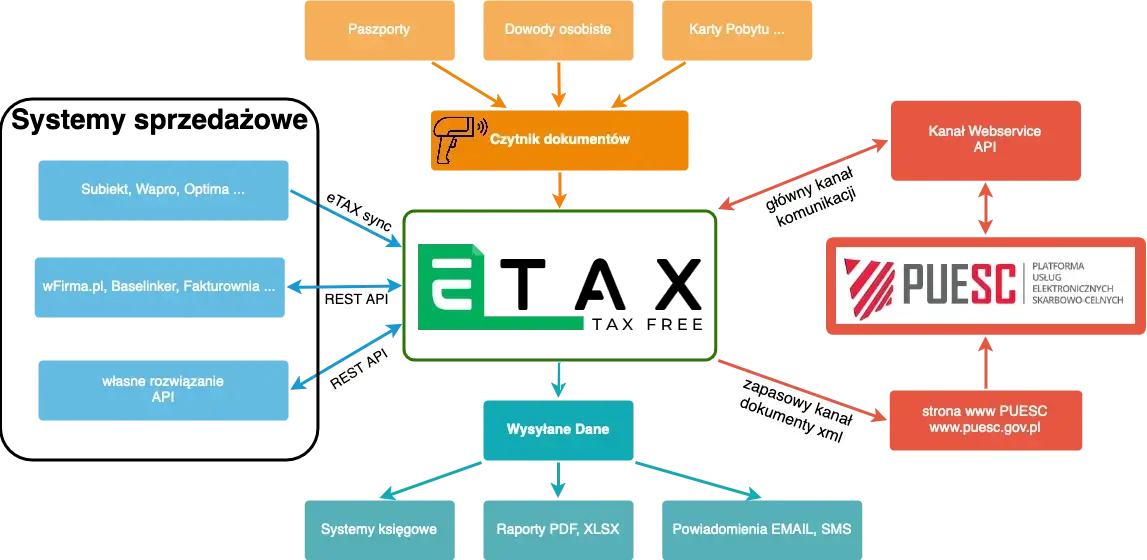

skróciliśmy czasu obsługi o 95%Przerzuciliśmy obsługę TAX FREE do eTax i w ciągu pierwszego miesiąca skróciliśmy czas potrzebny na wystawienie dokumentu do kilkunastu sekund. Zespół szybko odpowiada na pytania i pomaga w konfiguracji.

18 miesięcy z eTax